Accountants: How to deal with the STP September 2021 STP Deadline for your closely held clients

_Originally published: 27/04/2021 | Updated on: 02/09/2021_

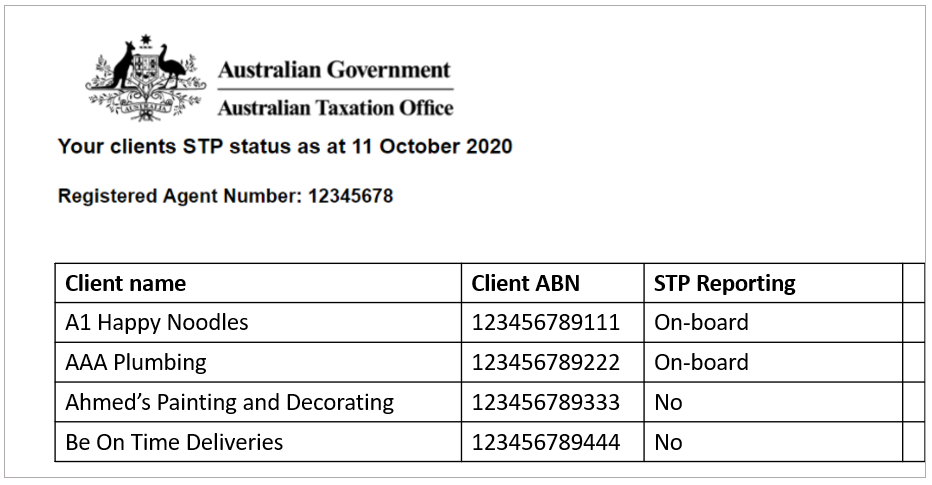

The ATO is currently writing to accountants and tax agents around Australia listing all their non STP compliant clients.

We know this because we got one too (that’s right, we’re also accountants!).

Previously, the ATO granted exemptions for certain types of businesses, meaning some businesses did not need to do STP reporting.

These exemptions included businesses where the payee is directly related to the business, as opposed to a normal arm’s length employee.

These are sometimes referred to as closely held payees, and are described by the ATO as where the person being paid is either:

- A family member of a family business

- Directors or shareholders of a company

- Beneficiaries of a trust

There were also exemptions for other types of small businesses which meant they did not need to do STP reporting.

These exemptions have now ended, meaning all small businesses (including those with closely held payees) are required to perform STP reporting from July 1st.

Closely helds, however, are able to do quarterly reporting using actual or estimate methods. This means the deadline to start STP reporting is the end of September.

Getting these clients onboard with STP can be a challenge because no two businesses are the same:

- A solution that works for some, won’t be a good fit for others

- Some small businesses want their accountant or tax agent to do it all for them

- Others will want to give it a go themselves, assuming they can find the right solution with the right support

- For some, its worthwhile investing time and energy working with their accountant to use an integrated accounting package with other features

- For others, a simple solution with the least amount of change is preferable

Having some flexibility in the approach allows accountants to offer their clients a more fit-for-purpose solution.

But it can take a lot of effort and tenacity to work with all clients to get them STP compliant.

So it’s worthwhile for accountants to look for an option that offers:

- Flexibility to do STP on their clients’ behalf, or have them do it themselves

- Quick and easy setup, with options for creating accounts via upload and no need to contact the ATO to register a software ID

- Flexibility to report quarterly estimates or actuals

- Good value

- Great customer support to both accountants and their clients

While some of the biggest accounting software players like Xero & Reckon have built STP solutions, they tend to be:

- Expensive

- Complex to use

- Hard to get started for their clients

- Not made for small businesses

Other companies are offering free STP solutions for small businesses that are great value but will actually create more work for accountants, due to:

- No Accountants’ Dashboard to manage all their clients easily from one place

- No support for either the accountant or their clients

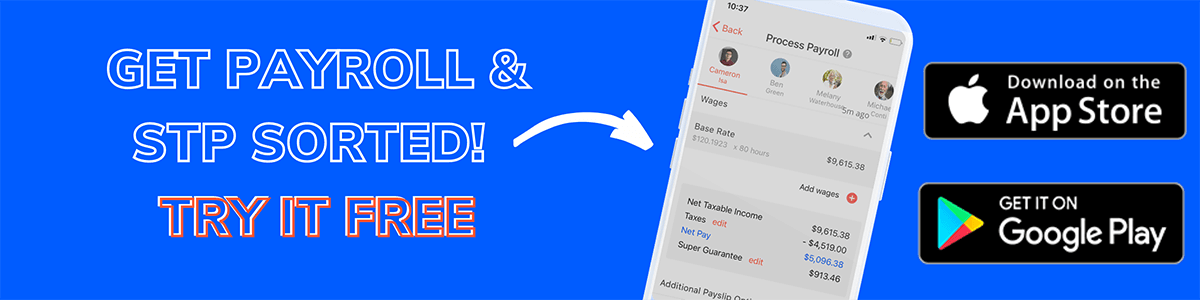

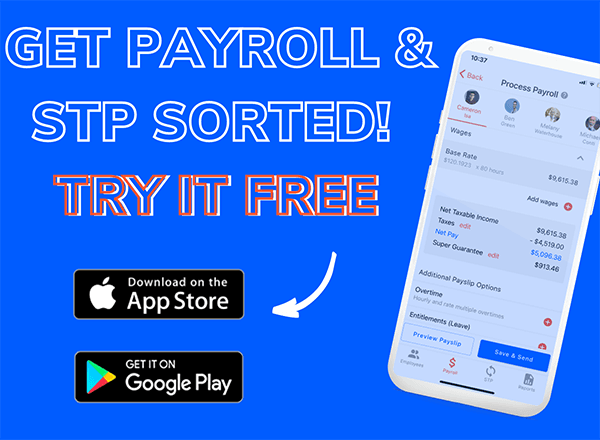

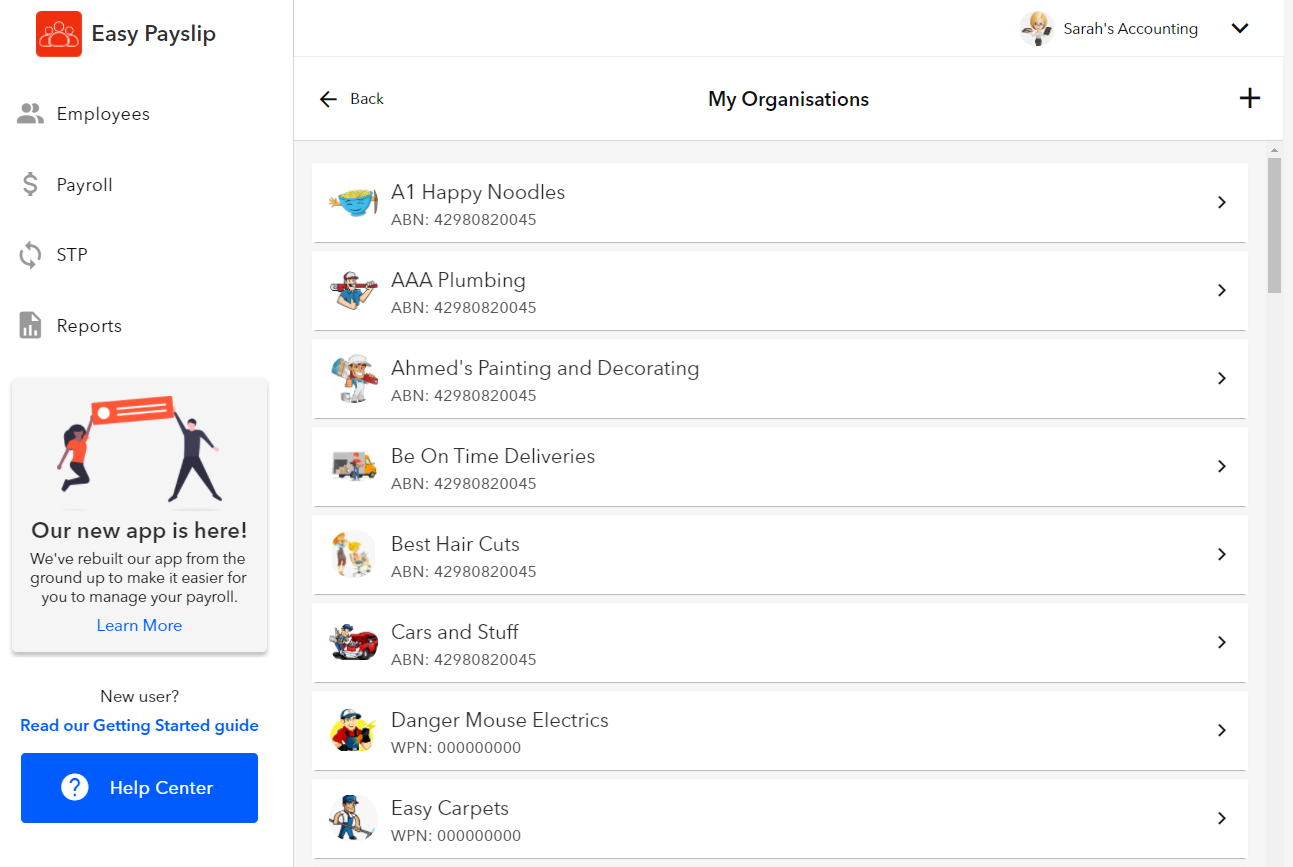

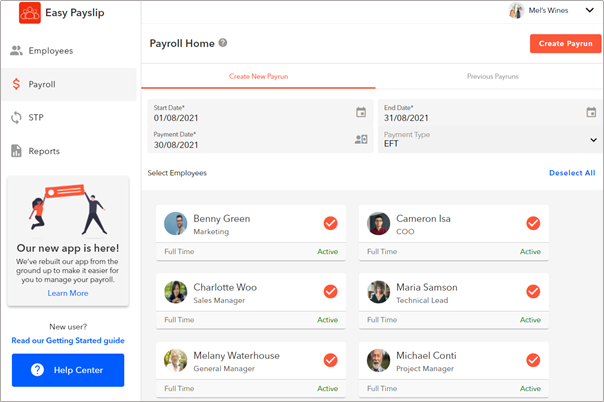

Easy Payslip is a simple solution that allows accountants and their clients to run their own payroll through web and mobile apps.

Accountants can add clients to their dashboard via website or mobile app, or via upload.

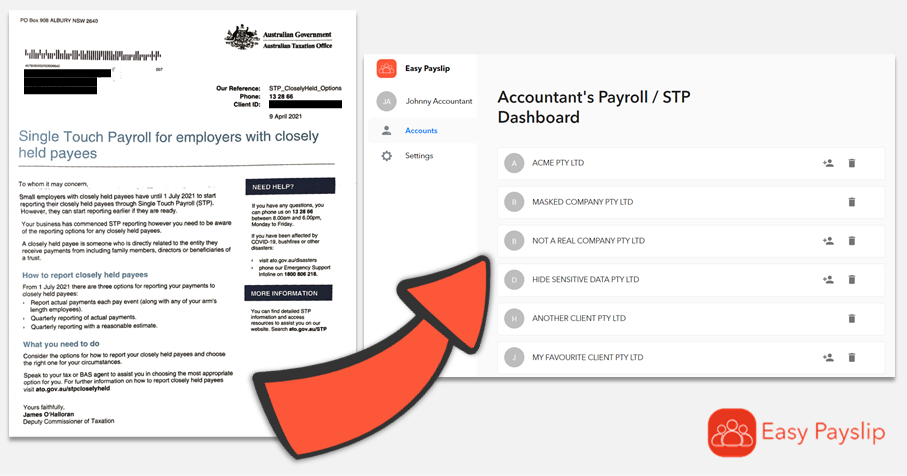

We can take this:

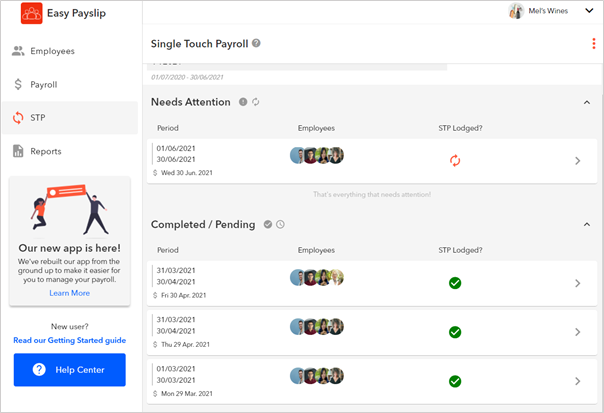

And turn it into your own dashboard like the one below:

Once the Dashboard is setup, accountants have the flexibility to:

- Do their clients’ STP reporting for them OR

- Invite them to access their own account so they can do it themselves

Clients can set up their own account from our website or mobile phone apps, too. It takes 10 mins to set up and send the first STP file. And they can then invite their accountant to access their account.

This gives accountants complete flexibility to manage their clients’ STP compliance in the way that suits them best. Better still, there is no need to contact the ATO and register a software ID for each client as it happens automatically.

Accountants also have a dedicated Easy Payslip partnerships director that they can call on as they need, plus their clients also have access to a Sydney-based support team. We’ve helped thousands of small businesses send their first STP files.

And all accountants, bookkeepers and tax agents get 4 months free for every new client, then only $8.80/month per client.

Start dealing with your STP compliance headache by signing up for your free accountant’s dashboard with Easy Payslip for Accountants or book a demo to see for yourself and have a chat with our Partnerships Director, Paul.

Ready to reduce STP headaches for you and your clients?

Create a Free Account Book a Demo

Not an accountant? Sign up here.

.png?width=812&height=188&name=Easy-Business-app-(colour).png)