How To Avoid ATO Fines By Setting Up STP In Minutes

The ATO’s single touch payroll rule was brought in a year ago, and the ATO has said they will start issuing fines from July for any business that is not compliant.

So now is the perfect time to get organised. How do you do this?

As a small business owner, the first thing you need to ask yourself is:

“What is the quickest and easiest way that I can become ATO STP compliant”

The answer to this question means identifying a way that fits in with how you run your business, and how you run your life. There are many different solutions (apps & softwares) out there and it can be difficult to find the one best suits you.

We would suggest that you consider prioritising some key features:

- Quick and easy setup (less than 10 minutes)

- Knowledgeable and Australian-based customer support

- Flexibility that fits in with your lifestyle (who wants to be tied down in an office!)

When you are ready to start, the first step is to get together some simple details:

- Information about your business: Your ABN and Business address

- Information about your employees: Their tax file number, their email address, their pay details

Once you’ve got that information, it’s time to select a payroll software that can do the work for you. You want to ensure that you’re covered for the features you need, such as:

- Quick and simple payslips

- STP compliance

- Superannuation tracking

- Holiday and sick leave

- Additional payslip options like overtime, additional base rates, allowances, deductions, bonuses, commissions and directors fees

- Useful reports

- Access that suits you, such as from a website, tablet or mobile phone

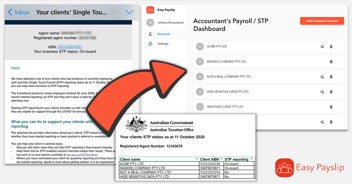

Here at Easy Payslip we provide all the options for a small business to take the hassle out of payroll and STP:

- Run payroll anytime, anywhere, on our simple to use mobile phone/tablet apps or website

- 5 mins to get setup, 2 mins to run payroll and send STP files

- Knowledgeable, patient, Sydney-based customer service that understands not everyone is a payroll expert or tech whizz

- Invite your accountant for that extra level of comfort

- 30 day free trial

- Costs less than 2 cups of coffee a month

We can help you get on the right side of ATO rules, and simplify the way you run your business. Getting setup is as easy as starting a free trial on your choice of:

Our Sydney-based team is only a phone call or email away if you need help, so don’t be afraid to get in touch, or check out our getting started guide.

.png?width=812&height=188&name=Easy-Business-app-(colour).png)