ATO Has Extended JobKeeper Deadline - Here’s What To Do!

Friday 8 May Update - The government have now announced that you have until 31 May to apply for JobKeeper for the first two fortnights, covering the period 30/3 - 26/4.

Thats right - you still have time to claim the JobKeeper Payment for April pay periods.

Below we have all the information you need included a comprehensive guide so you can get started with your JobKeeper processing.

There is some general information about JobKeeper from our previous blog posts down below so you can read that for an overview, or dive into our user guides for all the answers.

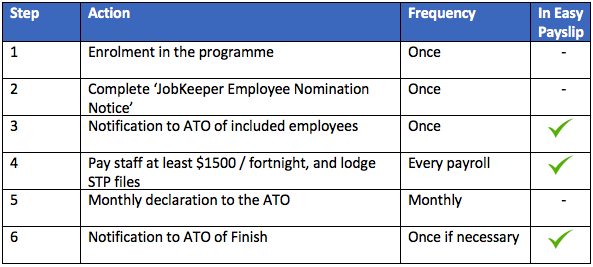

Here are the key steps to undertake:

To get a better understanding of how each of these steps work, and how to get going in Easy Payslip, we’ve now released our user guides.

JobKeeper Quick Guide and Reference

JobKeeper Start Guide: General Information and Background Understanding

New to Payroll and STP?

For businesses not yet onboard with single touch payroll, now is the time to get up and running. Using Easy Payslip’s free 30 day trial, you can be set up and sending STP files in 10 mins, using your choice of PC/Mac, Android phone, or iPhone.

Once you’re setup, you will then be able to perform the necessary JobKeeper Payment steps.

And if you run into any trouble or have questions, Easy Payslip has a Sydney based customer support team that is ready for your call or email.

Some key facts:

The JobKeeper scheme was confirmed as law by parliament on Wednesday, 8th April 2020. The scheme will commence from 30/03/2020 and will be in place for a term of six months only.

What is the JobKeeper Subsidy payment? The ATO will reimburse eligible participating employers an amount equivalent to $1,500 per fortnight per eligible employee, to be paid monthly in arrears. You can maintain your normal pay cycles for employees (weekly, fortnightly, monthly), but you will be reimbursed monthly in arrears.

Is My Business Eligible? It’s available to eligible businesses provided their turnover will be reduced by more than 30 per cent relative to a comparable period a year ago. Where a business was not in operation a year earlier or where their turnover a year earlier was not representative of their usual or average turnover, the Tax Commissioner will have discretion to consider additional information that the business is adversely affected ( More details are provided in the government links at the bottom of this post).

Which of my employees can be included? The employer must pay an employee at least $1,500 per fortnight (pre tax) for that employee to be eligible. If they are currently being paid less, then their pay can be increased to reach the $1,500 per fortnight in order to qualify. Wages do not have to be paid to employees fortnightly, they can continue to be paid using current pay periods, but they will be reimbursed on a fortnightly basis.

What’s the first pay period covered, and when will the first reimbursement be made? The starting period for which reimbursements will be made is the pay period of Monday 30 March - Sunday 12 April 2020, wages paid to eligible staff with any payment date within that fortnight. And then wages payments during each fortnight after that.

The first reimbursement payments by the ATO will be received by employers in the first week of May.

If you’d like to get started and don’t have an Easy Payslip account yet:

Using Easy Payslip’s free 30 day trial, you can be set up and sending STP files in 10 mins, so you’re ready for JobKeeper, using your choice of PC/Mac, Android phone, or iPhone.

And Easy Payslip has a Sydney based customer support team that is ready for your call or email if you’d like a hand getting started, or have any questions.

.png?width=812&height=188&name=Easy-Business-app-(colour).png)