How Accountants Solve STP and JobKeeper Headaches

With details recently released confirming that the Government’s JobKeeper payment is linked to Single Touch Payroll reporting, this has created a new sense of urgency.

It seems the ATO is linking the JobKeeper and other stimulus packages to the taxation system as a way of driving businesses towards their digital office agenda. Not to mention the fact that the year’s grace period for STP is almost over, and the ATO may start issuing fines for non compliance come July.

So why are there so many businesses not yet STP compliant, and struggling with JobKeeper? Our research shows that causes range from:

- Accountants don’t want the additional headache

- Small businesses (and accountants) don’t have the time

- Non office-based businesses are having trouble with the compliance burden

- Some employers are not very tech savvy

- Businesses can be fearful of new technology, and afraid of change.

We know that small businesses are time poor. And we know that compliance is a headache.

So what do small businesses want?

Small businesses want:

- Options for their accountant or bookkeeper to take care of their compliance headache

- Software that is easy to use, mobile, quick to set up, and doesn’t waste their time with options they don’t currently need

- The comfort that when they handle things themselves, they can have their accountants check what they’ve done to provide a level of assurance.

Small businesses tell us that they want simple solutions for simple problems. Whilst there may be a benefit to integrated platforms in the long run, businesses want compliance to be as easy and quick as possible.

This is especially relevant today, where businesses need Single Touch Payroll compliance to support their Job Keeper application.

What do accountants want?

In the current climate with STP necessary for JobKeeper and non-compliance fines on the horizon, our accounting partners tell us they want the easiest way possible to get their clients onboard with STP, with the least amount of friction.

The most important thing is the flexibility that allows them to:

- Monetise the opportunity effectively: using a simple solution where they can access all their clients from the one account, can process STP reporting quickly with a minimum of fuss, and even get help to set their clients up in the first place. Ideally with an introductory free period too, and quality, local customer support.

- Flexibility to offload their STP and JobKeeper burden: The option of having their clients run their own STP, knowing that there is a customer service team to help them get setup, provide instructions for all the JobKeeper steps, and be the first point of contact when they have questions.

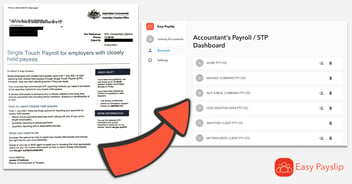

At Easy Payslip, we are helping accountants all over Australia to get their clients on board with STP, and performing all the JobKeeper onboarding steps.

See for your self by creating a free dashboard account, or book in a demo and we can show you how easy it is.

It takes less than 5 minutes to set up your own accountant dashboard. It’s then one click to add your client accounts. Easy Payslip can even create the client accounts for you via upload. And there is no easier system out there to create payslips and STP files.

If you clients want to do their own payslips, you can invite them to access their account.

Or if you’d prefer to make the STP and JobKeeper headache disappear, your clients can set up their own accounts in less than 10 mins on their choice of mobile phone app, tablet, or PC/Mac. And they can still invite you to access their account so you can check and run reports, or even submit STP files for them. Setup your free dashboard account here.

Easy Payslip is at the forefront of STP and Payroll cloud based technology. We were the the first to have the JobKeeper STP enrolment and processing steps available, and to provide comprehensive information and step by step guidance. And we continue to make enhancements to support the accountants and small businesses that rely on us.

Case Study: JobKeeper Ready

A Sydney-based accountant uses Easy Payslip to handle payroll, STP and JobKeeper setup for 120 (and counting!) of their clients. Whenever a new client needs to be added, they simply add them via their accountant dashboard and start processing. For those clients who prefer to create the payslips directly in the app, they can do so, knowing their accountant can always keep an eye out for any mistakes.

Case Study: Support along the way

With many clients who needed to get onboard with STP and JobKeeper, and limited capacity to handle any setup himself, this accountant simply asked his clients to create their own Easy Payslip accounts and then invite him to the account. The Easy Payslip customer service team helped a couple of the non tech savvy business owners set up their accounts, and helped all their clients with step-by-step JobKeeper instructions and phone support for onboarding.

Ready to reduce STP and JobKeeper headaches for you and your clients?

Create a Free Account Book a Demo

Not an accountant? Sign up here.

.png?width=812&height=188&name=Easy-Business-app-(colour).png)