Accountants, how to get your clients STP compliant for the new year

1. Why this is a top priority

There is a new sense of urgency this month for small businesses to be STP compliant, now that the one year grace period is over for STP compliance and fines are being threatened by the ATO.

Yet we are hearing plenty of concern from accountants and bookkeepers with small business clients still not compliant.

So why is it so difficult to get some small business clients onto an STP solution?

- Small businesses are fearful of introducing a new admin/paperwork burden

- They worry about support not being available when they need it

- They struggle with technology that needs a big investment of time to setup and understand – traditional accounting systems can be confusing

- Non office-based businesses struggle with compliance, as many software options do not cater to their needs

2. How to help your client get setup for STP

First, make sure you have got the correct authorisation to act on behalf of your small business clients. This will involve the client giving you the appropriate authority to submit information to the ATO for them.

Small business customers need their accountant/bookkeeper to be a trusted source of advice to help them navigate the technology out there, and find solutions that work for them.

They want:

- The option of their accountant to do it for them, or to do it themselves. Or a combination where they can do the day to day, with an easy way for this to be checked

- Options for compliance that take into account how they run their business and how they run their life

- Technology that is easy to use

- Responsive help and support when they need it.

Small businesses tell us that they want simple solutions for simple problems. Whilst there may be a benefit to integrated platforms in the long run, businesses want compliance to be as easy and quick as possible.

3. How to choose the right STP solution

You need to find a simple STP solution that meets your needs and that can be setup with a minimum of fuss, and without a steep learning curve.

Flexibility is important, so you got options to setup and run STP for your clients, invite them to be able to do it themselves, or share the load between you

Here are the top features you need from a solution:

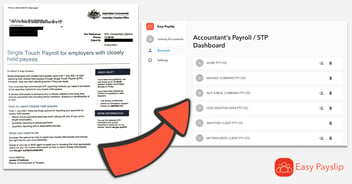

- A dashboard to manage all your clients in the one place

- Personalised support to get your clients setup

- 2 mins to run payroll and send STP files

- Easy Reports with W1 and W2 calculated for you

- Great local customer service team that’s the first point of call for you or your clients STP issues

- Click of a button to invite the client to access their account

- Access for small businesses on a choice of simple to use mobile phone & tablet apps or website

There are only a few solutions in Australia providing the above, including Easy Payslip for Accountants.

4. How to get setup quickly

Many STP solutions require you to register to their software ID in the ATO business portal.

However a few software providers (like Easy Payslip) will not require this step as the registration happens automatically when the STP file is first submitted, so its worth looking out for these ones as they can save time and remove a hurdle to getting started.

Whether you are doing STP reporting for your clients, or they are doing it themselves, Easy Payslip removes the burden by being the first point of call for everything to do with payroll and STP. We provide all the features required to manage your clients, and have great Australian based customer support.

Setup a free dashboard account and you’ll be on your way in 5 mins, or take a look at our help guide. Even better, schedule a demo and we can show how easy it is.

By visiting our dedicated accountants page you will have access to:

- Get 3 months free for each client account

- Book a demo via our online calendar

- Create your free accountants’ dashboard account

.png?width=812&height=188&name=Easy-Business-app-(colour).png)